Attending Global Pet Expo 2016? – It’s Bigger than Ever! What’s Your Plan?

Global Pet Expo has earned the title of “Greatest Show on Earth” and has some “impressive” statistics. However, for attendees, a different word might come to mind…perhaps, intimidating?

At GPE 2016 there are:

- Over 1100 separate exhibitor booths

- 334,000 square feet of exhibitor booths (Plus 30,000 sq ft for the New Product Showcase)

- 1000 new items in the New Product Showcase plus 2000 more launched on the exhibit floor

- Over 16,000 attendees with more than 6000 “buyers”.

- 30 different educational seminars (plus 1 repeat) – 33 hours of classes

- 5 miles of aisles – just to walk the exhibit floor

The show floor is open for 26 hours so…Let’s “Do the Math!”

If you don’t attend any seminars, visit the New Product Showcase, stop to chat with anyone in the aisles or for food, a drink or to go to the bathroom and maintain a walking speed of 2.5 mph, you can spend about 1 minute and 20 seconds with each exhibitor…Perhaps you need a plan…??

There are a lot of fun things to do in Orlando and the weather provides a great break for those of us in the Northern latitudes. However the primary purpose for attending GPE or any industry event must be to improve your business.

[box]With 1100+ Exhibitors you can spend 1 minute and 20 seconds with each, if you don’t eat, drink, go to a class, go to the restroom…and walk fast! You need a plan!

[/box]

GPE is primarily about Pet Products – Food, treats and a vast array of Supply categories. New Products are a critical element in helping to turn around the current deflation in Food and Supplies so of course, you must take the time to visit the new product area. You should also sign up for any relevant classes, network with other industry professionals and…walk the whole show. The GPE is about gathering information and making decisions to improve your business – whether they are made on the spot or put on your “must do” list.

Every business can improve in terms of products. If you are a retailer, what sections of your store are not doing as well as you hoped and need a “facelift” or conversely, what areas are growing and need products to fill additional space? Category managers for distributors and retail chains may only be interested in targeted visits to exhibitors relevant to their “categories”. Representatives may be looking for new manufacturers…in specific product categories. Manufacturers could be looking to find distributors to handle their products or just looking to “check out” the competition. In regard to products, there is always something to see…for everyone!

Both the GPE and the Pet Industry have grown tremendously and the influence of Pet Products is widespread across Retail America. I don’t know if we fully appreciate just how widespread. If you include Veterinary Clinics and Service Establishments, Pet Products – food and/or supplies are sold in 200,000 U.S outlets – including 69 of the top 85 non-restaurant retailers in the U.S. …plus the Internet! And according to A.C. Nielsen, 62% of all consumer shopping trips are for $20 or less. As expected, the biggest “drivers” are #1 Milk and #2 Bread, but #3 is…pet products…the only nonhuman food item in the top 10. It’s a competitive, consumer driven market.

So you’re most definitely going to GPE 2016, how do you make the most out of your time? Here’s an idea…

In 2014 I first designed a tool in Excel, the Super Search Exhibitor Visit Planner to make “working SuperZoo” easier and more productive for ALL attendees – retailers, distributors, reps, groomers, vets…even exhibitors. I have updated the data and produced a tool for every GPE and SuperZoo since then…including GPE 2016.

When I say “update the data”, I am referring not just to exhibitor lists but also to the product category offerings for every exhibitor. Of course I reviewed every exhibitor profile on the show site but I also visited over 1000 websites to “validate” the offerings. It is not 100% accurate. However, it is close.

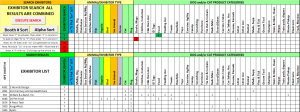

What does the SuperSearch do?…It searches for and produces a list of Exhibitors by product categories.

- From the simplest…”just give me a list that I can look at on my phone or tablet quickly in either Booth # order or alphabetically”

- To the most complex…”can do a simultaneous search for multiple specific product categories, allowing me to personally narrow down the initial results and see the “final” alphabetically or by booth number.

The GPE SuperSearch Exhibitor Visit Planner does both…and more…and does it quickly! Here’s what it looks like. It looks complex but is truly quite simple…Of course, you will print results in “landscape” – because it’s easier to read!

- In the Top section, you “design” your searches.

- Enter a “Y” in the exhibitor search column. It turns green to indicate an “active” search

- Enter a “1” the desired category

- If you want to search separately for several categories, use multiple rows (multiple search results are combined into 1 list for efficiency)

- If you want the results to be “and”…for example, exhibitors that carry, treats, toys and beds, put a “1” in all three…in the same row. Only those with all 3 will show up.

- Note: If you enter something other than a “1”, the cell turns red to indicate an error

- Now, click on “Execute” search and it happens

- You can then view the results alphabetically or in booth # order by clicking on a button.

Pretty simple, don’t you think? Plus, you can personally narrow the search results by using the “U pick ‘em” feature. And of course there is also a button to clear your search criteria so you can easily begin a new search.

Ready to Start Planning?

There are download links below for the GPE 2016 Super Search tool as well as one for the instructions. Please print out and read the instructions before you start to “play”. Yes, the instructions are 4 pages long. But before you get “turned off” about their length, take a look at some of the instructions that you have around the house…vacuum cleaner – 11 pgs; coffee maker – 21 pgs; cell phone…a novel! After you see what the Super Search can do, your searches may grow more complex. The instructions will help you to be more efficient from the start… Note: The File has been updated. GPE 2016 SuperSearch is based on info as of 3/9. Six new exhibitors were added since the 3/9 update and a total of 14 since the 2/22 original. This is the final update before the show. Check the date in the file name. The exhibitors added between 3/2 and 3/9 are “highlighted” in pink. Those added from 2/22 to 3/2 are “highlighted” in blue.

Plan your work! Work your plan! You will be more productive and more successful!

Download Now and Get Started!

[button link=”https://petbusinessprofessor.com/wp-content/uploads/2016/02/GPE-2016SuperSearchEXHIBITOR-VISIT-PLANNER-Instructions.pdf” type=”icon” newwindow=”yes”] Download Instructions (PDF)[/button]

(To save the PDF to your computer Right Click the download link and select “Save Link As…”)

[button link=”https://petbusinessprofessor.com/wp-content/uploads/2016/03/GPE-2016-SuperSearchRev-3-9-16.xlsm” type=”icon” newwindow=”no”] Download SuperSearch GPE 2016 -3-9-16(Excel)[/button]

(For the Excel file to work on your computer, be sure to enable macros/editing)